Pay by bank transfer

You can arrange with your bank to pay your rates by phone or internet banking.

Please use the following details when making your payment by online banking to ensure it will be receipted correctly.

Bank: Bank of New Zealand (BNZ)

Account name: Waitaki District Council

Account number: 02 0940 0156400 00

It is essential that you include the required information in the 'Particulars', 'Code' and 'Reference' columns when you make a payment. Without this information, we may not be able to allocate your money to your outstanding payment – which could result in unnecessary problems and delays

How to set up a bank transfer correctly

Enter the correct information in each of the 3 fields your bank provides for you; 'Particulars', 'Code', and 'Reference'.

Particulars

Customer Name from the Rates Assessment Notice. Enter surname, a space then initials or company name only. Limit 12 characters.

Code

"RATES"

Reference

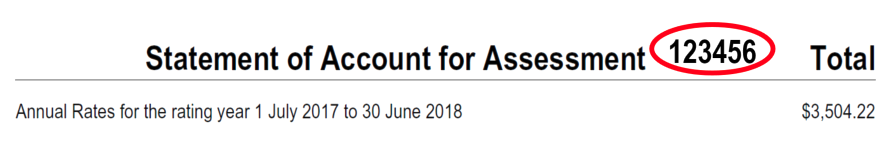

Rates Assessment Number from the Notice. This is a six-digit number with no alpha characters (e.g. 123456 )

Use the samples below to ensure you enter the correct Assessment number on the notice

Important note:

Please do not make one transfer for several accounts- for example, three rate accounts, a water account and a dog registration. Instead, split the payment with the appropriate payment particular and reference details to ensure that the payment is made to the correct account.

Ratepayers with automatic payments are responsible for keeping these up to date. This means ensuring the amounts are sufficient to clear the rates by all of the required due dates, that the Assessment References are correct, and that they are cancelled if a property is sold .